*Your referral must be a member for a minimum of 6 paid months to become a Qualified Referral. Referrals must hold the Step for a minimum of 6 months in order to qualify for said Step. The following examples explain this requirement.

Example. 1

Tom has (3) Step 1 Referrals that have been members for 7 months. He also has (4) Step 2 Referrals that have been members for 6 months and (4) other Step 2 Members that have been at Step 2 for only 5 months. In this case, the (4) members will be counted as Step 1 Qualified Referrals or Tom can wait 1 more month so the other (4) will count as Step 2 Qualified Referrals.

Example 2.

Bob has (16) referrals that have advanced to Step 3. (12) Have been Step 3 Referrals for the minimum of 6 months. The other (4) members have only been at Step 3 for 5 months, so they will be counted as Step 2 Referrals, or Bob can wait 1 month so the (4) referrals can be counted as Step 3 Referrals, increasing the loan amount significantly.

* The maximum amount of each loan is calculated by:

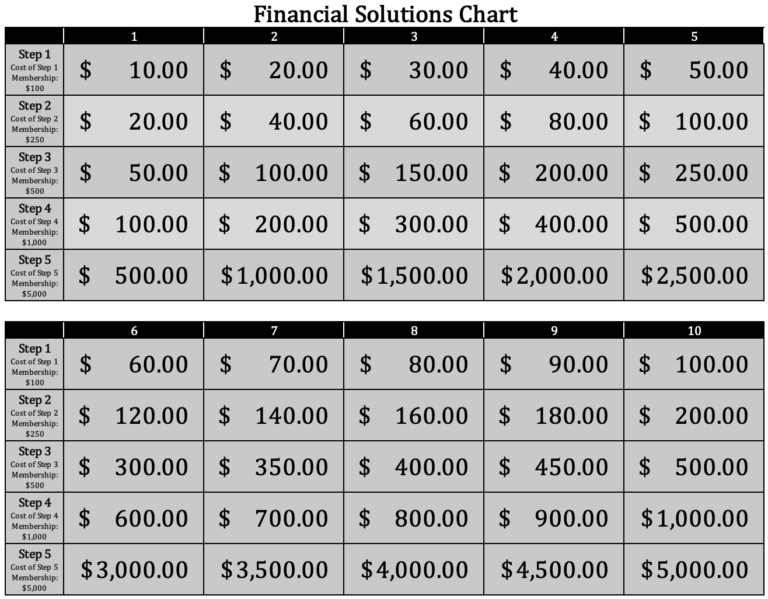

Adding the Total Amount that each Qualified Referral is paying towards your Financial Solutions FtP account for the month.

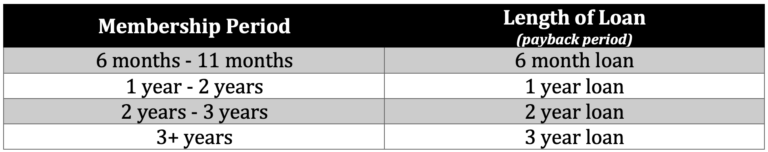

Multiplying that number by the number of months the member is qualified to receive a loan for will give you the total loan amount.

To better explain how the loans will be calculated, we included a few scenarios on how Financial Solutions FtP will figure the Total Amount of the Loan, the Maximum Length of the Loan Term and the Minimum Payment Amount.

Tom has met his minimum requirements for a 6 month loan and would like to know the amount of the loan he qualifies for.

His current qualified referrals are as follow:

(20) Step 1 Qualified Referrals.

A. How much are Tom’s Commission Earnings per month?

(Step 1 earns $50 commission per referral x 20 Referrals)

$50 x 20 referrals =

$1000 Monthly Commission

Minus $100 Step 1 Monthly Fee

B.How much can Tom borrow on a 6 month loan?

To calculate how much Tom can borrow on a 6 month loan, you would add the total amount of each of his Qualified Referrals*contribute to the FSF Account* the month the loan was requested, and multiply that times the total lengh of the loan he qualifies for.

*FSF Account- Financial Solutions FtP Account

(20) Step 1 members contribute $10 each per month to the FSF Account-=$200

$200/Month X 6 month loan =

Zero% Interest Total loan amount of $1,200.

C.How much will Tom’s payments be?

Total Loan Amount $1,200 ÷ divided by the length of the loan (6 months) =

$200/Month

(Withdrawn from Tom’s Monthly Commission Earnings)

Bob has reached his minimum requirements to request a 6 month loan and currently has (14) qualified referrals, which vary in steps of membership.

His qualified referrals are as follows:

(10) – Step 1 Qualified Referrals

(4) – Step 2 Qualified Referrals

A.What are Bob’s Commission Earnings per month?

(10)-Step 1 referral commission payout is $50 each totaling = $500

(4)- Step 2 referral commission payout is $150 each totaling = $600

$500+$600= $1100/Monthly Commissions

(Minus Step 2 Monthly Fee of $250) =

$850 Monthly Commission Earnings

B.How much can Bob borrow on a 6 month loan?

(10) Step 1 Members contribute $10 each per month to the FSF Account-$100

(4) Step 2 Members contribute $20 each per month to the FSF Account-$80

$100 + $80 = $180/ Month contributed to the FSF Account.

$180/Month X 6 Month loan =

Zero% Interest Total loan amount of $1,080

C.How much will be Bob’s payments be?

Total Loan Amount ($1080) ÷ divided by the length of the loan (6 months)

$180/Month

(Withdrawn from Bob’s Monthly Commission Earnings)

Marie is currently a Step 3 member and would like to request a loan of $6,250 to pay off credit card debt. She has been a member for 1 year & 3 months, therefore qualifies for a 1 Year Loan.

Her current qualified referrals are as follows:

(22) – Step l Qualified Referrals

(6) – Step 2 Qualified Referrals

(4) – Step 3 Qualified Referrals

A.How much are Marie’s Commission Earnings per month?

(22) – Step 1 referral commission payout is $50 each ($1,100 Monthly Commissions)

(6) – Step 2 referral commission payout is $150 each ($900 Monthly Commissions)

(4) – Step 3 referral commission payout is $250 each ($1,000 Monthly Commissions)

($1100+$900+$1000 = $3000)

(Subtract the $500 Step 3 Monthly Membership Fee)

Equals = $2,500/Monthly Commission Earnings

B.What is the maximum amount she can borrow?

(22) Step 1 Members contribute $10 each to the FSF Account-$220 per month.

(6) Step 2 Members contribute $20 each to the FSF Account-$120 per month.

(4) Step 3 Members contribute $50 each to the FSF Account-$200 per month.

$220 + $120 + $200 = $540/Month contributed to the FSF Account.

$540/Month X 12 Month loan =

Zero% Interest Total loan amount of $6,480.

C.What will her payments be?

Total Loan Amount ($6480) ÷ divided by the lengh of the loan (12 months)

$540/Month

(Withdrawn from Marie’s Monthly Commission Earnings)